Secret Steps to Achieve Success With Reliable Offshore Business Development

When starting offshore business formation, choosing the ideal jurisdiction is extremely important. Factors such as political security, economic environment, and lawful frameworks play vital roles in this decision-making procedure. Navigating these intricate regions calls for a mix of thorough research and specialist suggestions to guarantee conformity and maximize tax advantages. Understanding these fundamental actions not just sets the stage for successful international development yet additionally highlights the complex dancing between risk and benefit in international company.

Selecting the Ideal Territory for Your Offshore Business

When establishing an overseas service, choosing the right territory is essential. Entrepreneurs have to think about different variables consisting of political stability, financial atmosphere, and the track record of the territory. A stable political climate makes sure that business procedures are not threatened by local turmoils. Additionally, a financially audio atmosphere recommends a reputable banking sector, vital for service deals.

Tax obligation effectiveness additionally plays a considerable function in jurisdiction option. Many offshore locations offer tax incentives to bring in foreign investment, which can substantially minimize a company's monetary concerns. However, the advantages of reduced taxes must be considered against the possibility for worldwide scrutiny and conformity problems.

Finally, the high quality of lawful facilities can influence company operations. Territories with strong legal systems provide much better protection for copyright, more clear agreement enforcement, and more efficient dispute resolution mechanisms. Entrepreneurs should completely research study and review these facets to guarantee their overseas endeavor is improved a strong foundation.

Browsing Lawful and Regulative Structures

After selecting a suitable territory, companies must faithfully browse the complex legal and governing frameworks that regulate their operations offshore. This task involves understanding and adhering to a wide selection of regulations that can vary considerably from one country to an additional. Secret areas often consist of corporate governance, work regulations, privacy regulations, and industry-specific conformity requirements.

To effectively manage these needs, business often engage neighborhood lawful experts who can give understandings right into the nuances of the territory's legal system. This know-how is critical for establishing frameworks that are not just compliant however also optimized for the operational goals of business. Additionally, continual surveillance of legal changes is crucial, as non-compliance can lead to severe penalties, including penalties and reputational damages. Preserving a dexterous approach to regulatory conformity is essential for any kind of organization intending to maintain its overseas procedures efficiently.

Leveraging Tax Advantages in Offshore Jurisdictions

One of the most compelling factors for companies to develop operations in overseas jurisdictions is the possibility for considerable tax obligation advantages. Offshore economic centers normally provide motivations why not try this out such as no capital gains tax obligation, no inheritance tax obligation, and decreased company tax prices.

Moreover, the opportunity of postponing taxes by holding earnings within the offshore business permits businesses to reinvest their incomes right into expanding procedures or r & d, additionally sustaining growth and advancement. Nonetheless, it is essential for firms to browse these benefits within the legal structures and global tax compliance requirements to stay clear of effects such as penalties and reputational damages. Utilizing these tax structures successfully can lead to significant lasting financial benefits for companies.

Carrying Out Thorough Due Diligence

While checking out the prospective tax obligation benefits of overseas territories, services need to additionally a knockout post focus on carrying out detailed due persistance. This procedure is critical in recognizing lawful, economic, and functional dangers connected with offshore company operations. Companies ought to carefully examine the regulative environment of the chosen territory to make certain conformity with both regional and international regulations. Offshore Business Formation. This consists of comprehending tax commitments, organization enrollment needs, and any potential financial permissions or anti-money laundering policies.

Evaluating political security and financial problems within the jurisdiction also develops an essential part of due diligence. Such evaluations assist in projecting possible challenges and sustainability of the business setting, guaranteeing that the overseas venture stays protected and viable over time.

Partnering With Trustworthy Local Experts and Advisors

Engaging click with regional experts additionally promotes smoother assimilation into the business community, fostering relationships that can result in long-lasting benefits and support. Offshore Business Formation. They act as crucial intermediaries, helping to link the void between foreign business methods and regional expectations, thus reducing misconceptions and conflicts

In addition, these experts contribute in browsing governmental processes, from enrollment to acquiring necessary permits. Their competence makes certain that organizations abide by neighborhood regulations and regulations, avoiding expensive lawful issues and potential reputational damages. Hence, their role is essential in developing a effective and lasting offshore enterprise.

Conclusion

In conclusion, success in offshore company development hinges on choosing the best territory, comprehending lawful and tax obligation frameworks, and carrying out considerable due diligence. Therefore, a well-executed offshore method not just minimizes risks but likewise maximizes chances for lasting business success.

Jaleel White Then & Now!

Jaleel White Then & Now! Erik von Detten Then & Now!

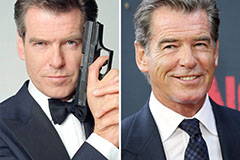

Erik von Detten Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!